🕰️ Recap : Trade, Learn, Reset

Today was a classic reminder: even on choppy days, the market teaches. We opened on shaky ground thanks to soft macro data, and I got clipped out of my $BROS position from last week. It happens. The size was slightly heavier than usual, so risk control took the wheel.

Takeaway: Stick to the plan. Accept shakeouts. Reset with clarity.

While I exited $BROS, I added $FROG and $META today on clean breakouts. The watchlist fired beautifully, reinforcing why prep matters.

🔑 Key Market Drivers

🏭 Soft Manufacturing Data: A weak print shook sentiment early, dragging major indexes down ~1% right at the open.

💻 Tech Resilience: But once again, Big Tech played hero — catching a strong bid and flipping the tape green. Bulls defended the dip with conviction.

🧭 Market Conditions

📊 Price Levels

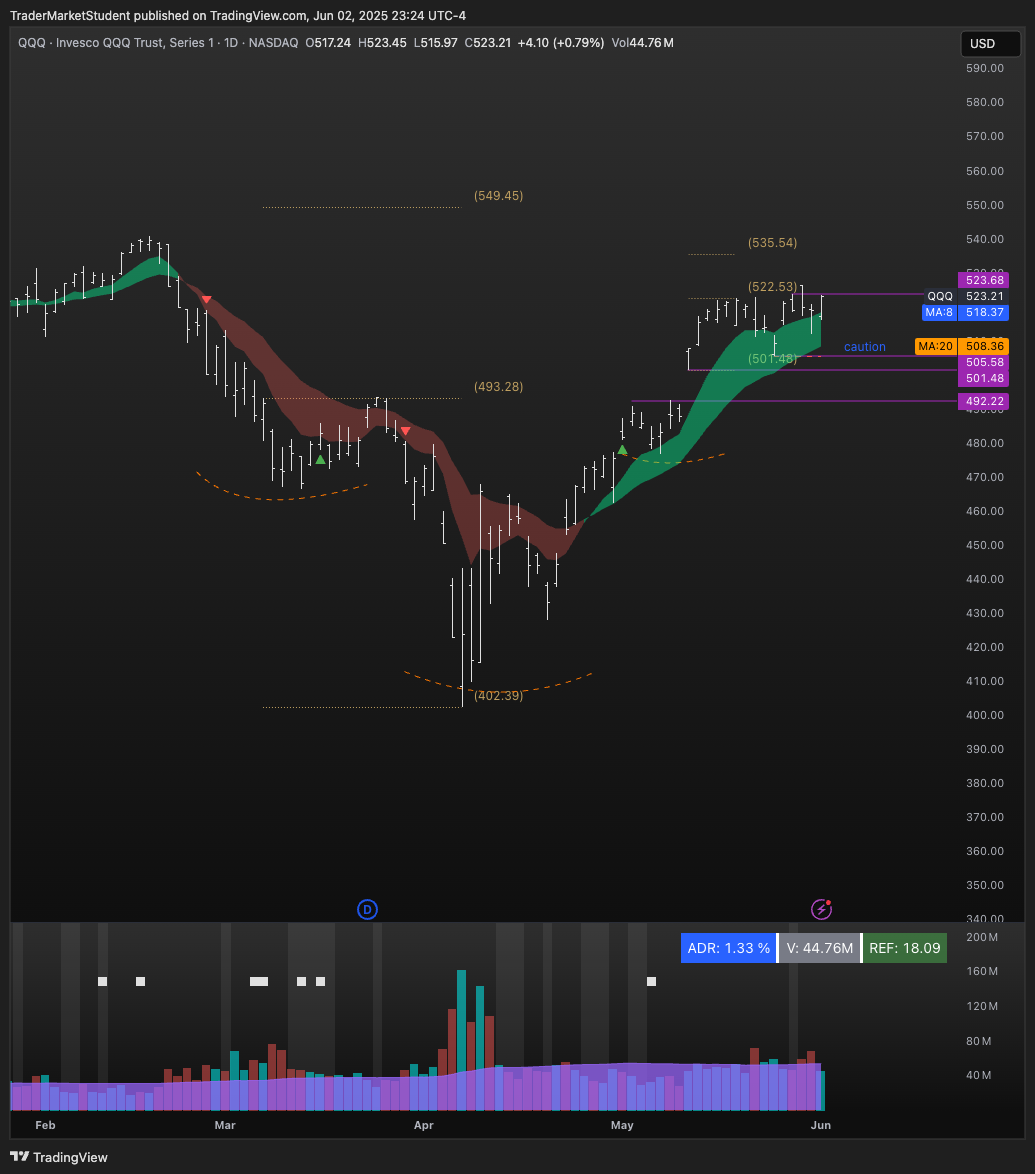

$QQQ

Holding above the 8EMA & 20EMA.

Key Support: 505, with 500 as the line in the sand.

Breakout trigger: 524

Upside Targets: 539, then 549 (Inverse Head & Shoulders target).

Lose 505, then 500 ,and = Gap-fill lower. Break 524 = Go time.

📉 Breadth & Internals

The market may be green on the surface, but breadth is still sending a yellow light. Here’s the breakdown:

Conclusion: We're in a “selective participation” environment — breakouts can work, but not everything will run. It's a stock picker’s tape. Trim size, tighten risk, and let setups prove themselves.

📅 Key Events

$CRCL IPO on June 05

Economic Calendar:

Earnings :

📌 Sources: EarningsHub, TradingView

🔮 Stocks of Interest (SOI)

I’ve shared my dynamic stop strategy before:

LOD Stops = More size

below demand zone stops = Starter size, scale in as support confirms

Let’s dig into the setups I’m watching closely.

🔮 Charts

QQQ

META

WMT

FROG

DDOG

COIN

JPM

ONON

SMR

BROS

CORZ

AMZN

MGNI

TOST

NRG

OKLO

🚀 Crypto Corner

₿ Bitcoin printed a high-handle structure — could be a setup for higher. I’ve locked gains near $105K. Watching closely for confirmation before reloading. Until then, patience is the edge.

🧠 Final Thoughts

Discipline > Predictions

With breadth soft and internals murky, it’s a time to protect gains, size down, and wait for clarity. Progressive exposure!

See you back here tomorrow. Trade well, and stay sharp.

⚠️ Disclaimer⚠️

This analysis only reflects my personal trading journal—how I’m thinking through and navigating the market. It is NOT investment advice. Always do your own research and consult with a qualified financial advisor before making any investment decisions.